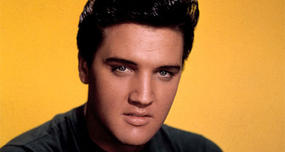

During the peak of his career in the 1950s and 1960s, Elvis Presley was in the highest tax bracket—which reached 91-92%—making him one of America's top taxpayers.

Elvis Presley Was in the 91% Tax Bracket at His Peak

Colonel Tom Parker, Elvis Presley's legendary manager, once said he considered it his "patriotic duty to keep Elvis up in the 90 percent tax bracket." This wasn't hyperbole—during the peak of Elvis's career in the 1950s and early 1960s, the top marginal tax rate in the United States really was 91-92%.

What does that mean? In America's progressive tax system, you don't pay the top rate on all your income—just on the dollars above a certain threshold. But when you're the King of Rock and Roll, earning millions from records, movies, and sold-out shows, a lot of your money falls into that top bracket.

The Biggest Taxpayer in America

By 1973, Elvis was officially the largest individual taxpayer in the United States. That year alone, he earned $8.2 million from personal appearances, music, recording, and films—and paid $2.96 million to the IRS. That's an effective rate of about 36%, which sounds lower than 91% because of how marginal rates work: only his highest earnings were taxed at the maximum rate.

For context, the top marginal rate had peaked even higher during World War II, hitting 94% in 1944-45. By the time Elvis exploded onto the scene with "Hound Dog" and "Jailhouse Rock," the rate had settled at 91-92%, where it stayed throughout the Eisenhower presidency.

Why So High?

Post-war America used steep progressive taxation to fund infrastructure, the military, and social programs while paying down war debt. The philosophy was simple: those who benefited most from the American dream should contribute the most to maintaining it.

Elvis reportedly didn't even deduct most of his charitable giving—and he gave a lot. He famously bought Cadillacs for strangers, donated to countless causes, and performed benefit concerts. But he let Uncle Sam keep the full bite anyway.

A Different Era

Today's top federal income tax bracket is 37%—less than half what Elvis faced. The dramatic shift began in the 1960s, with rates dropping significantly under Kennedy, Johnson, Reagan, and subsequent administrations.

Colonel Parker's "patriotic duty" quote captures a fascinating tension: he wanted Elvis to earn more, which meant paying more in taxes. It's hard to imagine a modern celebrity's team bragging about keeping their client in the highest tax bracket, but in Elvis's era, being a top taxpayer was a badge of success—proof you'd made it to the absolute peak of American prosperity.

Frequently Asked Questions

What tax bracket was Elvis Presley in?

How much did Elvis Presley pay in taxes?

What was the highest tax rate when Elvis was famous?

Why were tax rates so high in the 1950s?

Did Elvis Presley donate to charity?

Verified Fact

Corrected to specify this refers to marginal tax bracket, not effective rate. During 1950s-1960s, Elvis was in the 90-92% top marginal bracket. In 1973, he paid ~36% effective rate but was still in highest bracket.

Related Topics

More from Entertainment