The IRS officially requires criminals to report income from illegal activities like drug dealing, theft, and bribes on their tax returns. While the Fifth Amendment protects them from having to reveal the source of the income, failing to report it is still tax evasion—which is exactly how they got Al Capone.

The IRS Wants Drug Dealers to File Their Taxes

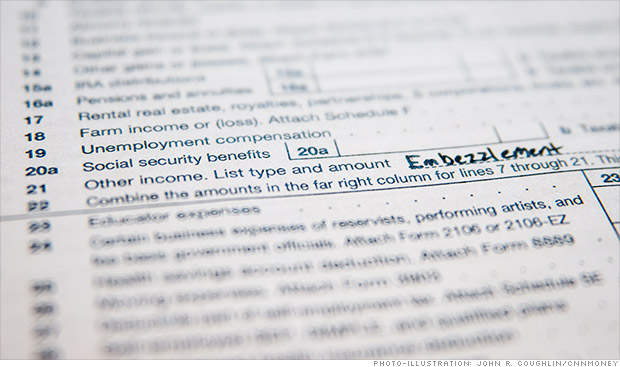

Buried deep in IRS Publication 17 is one of the most absurd-sounding guidelines in American tax law: "Income from illegal activities, such as money from dealing illegal drugs, must be included in your income." Yes, the federal government genuinely expects criminals to file their taxes.

And it doesn't stop at drug dealing. The IRS wants you to report bribes, kickbacks, embezzled funds, and even stolen property—though only if you don't return it to its rightful owner within the same tax year. How thoughtful.

The Al Capone Rule

This isn't just bureaucratic absurdity—it's a deliberate trap. The requirement traces back to the 1920s and America's most famous gangster. Despite running a bootlegging empire grossing an estimated $105 million annually, Al Capone never filed an income tax return in his name.

Federal prosecutors couldn't nail him for murder, bootlegging, or racketeering. But tax evasion? That stuck. In 1931, Capone was sentenced to 11 years in federal prison—not for being a crime lord, but for not paying his taxes.

But Can They Use It Against You?

Here's where it gets legally interesting. The Fifth Amendment protects you from self-incrimination, which creates an obvious conflict: how can the government force you to confess to crimes on a federal form?

The Supreme Court addressed this in United States v. Sullivan (1927). The ruling was nuanced:

- You must report the amount of your income—all of it

- You may invoke the Fifth Amendment to avoid disclosing the source

- You cannot refuse to file entirely

So you could theoretically write "$500,000" on Line 8z and "Fifth Amendment" as the source. Whether the IRS would accept that without scrutiny is another matter.

The Confidentiality Catch

The IRS is bound by strict confidentiality rules under Internal Revenue Code Section 6103. They can't just call the DEA and say, "Hey, this guy reported $2 million in 'other income' with no explanation."

However—and this is important—law enforcement can obtain tax returns through a court order. If the FBI or local police are already investigating you, they can petition a judge for access to your tax records. Your meticulous drug-dealing Schedule C becomes evidence.

The Double Bind for Drug Dealers

Section 280E of the tax code adds another twist. While you must report illegal income, you cannot deduct business expenses related to trafficking controlled substances. Legal marijuana dispensaries face this exact problem—they pay taxes on gross revenue because they can't write off rent, payroll, or utilities.

So if you're dealing drugs, you're expected to pay taxes on every dollar earned with zero deductions. Don't report it? Tax evasion. Report it honestly? You've created a paper trail for prosecutors.

Why This Exists

The logic is simple: the government taxes all income, regardless of how it was obtained. The IRS doesn't care if you're a teacher or a trafficker—they want their cut. And if you refuse to pay, they have a proven method for putting criminals behind bars that doesn't require witnesses, physical evidence, or cooperation from scared informants.

Just ask Al Capone.

Frequently Asked Questions

Does the IRS really require criminals to report illegal income?

Can the IRS share your tax return with police?

Why was Al Capone convicted of tax evasion?

Can you claim the Fifth Amendment on your tax return?

Can drug dealers deduct business expenses on their taxes?

Verified Fact

Corrected the misleading claim that 'they can't prosecute for it.' While the IRS generally can't proactively share tax info with law enforcement, the Fifth Amendment only protects disclosure of the SOURCE of income, not the requirement to report it. Law enforcement can obtain tax returns via court order.